When you’re in need of a personal loan but have a poor credit history, it can be tough to know where to turn. Many people with bad credit assume that they won’t be able to get a loan at all, but that’s not always the case.

There are a number of places you can go for a bad credit personal loan, you just need to know where to look. One option is to go to a traditional bank or credit union. However, the interest rates for bad credit personal loans tend to be high, so you may want to consider other options.

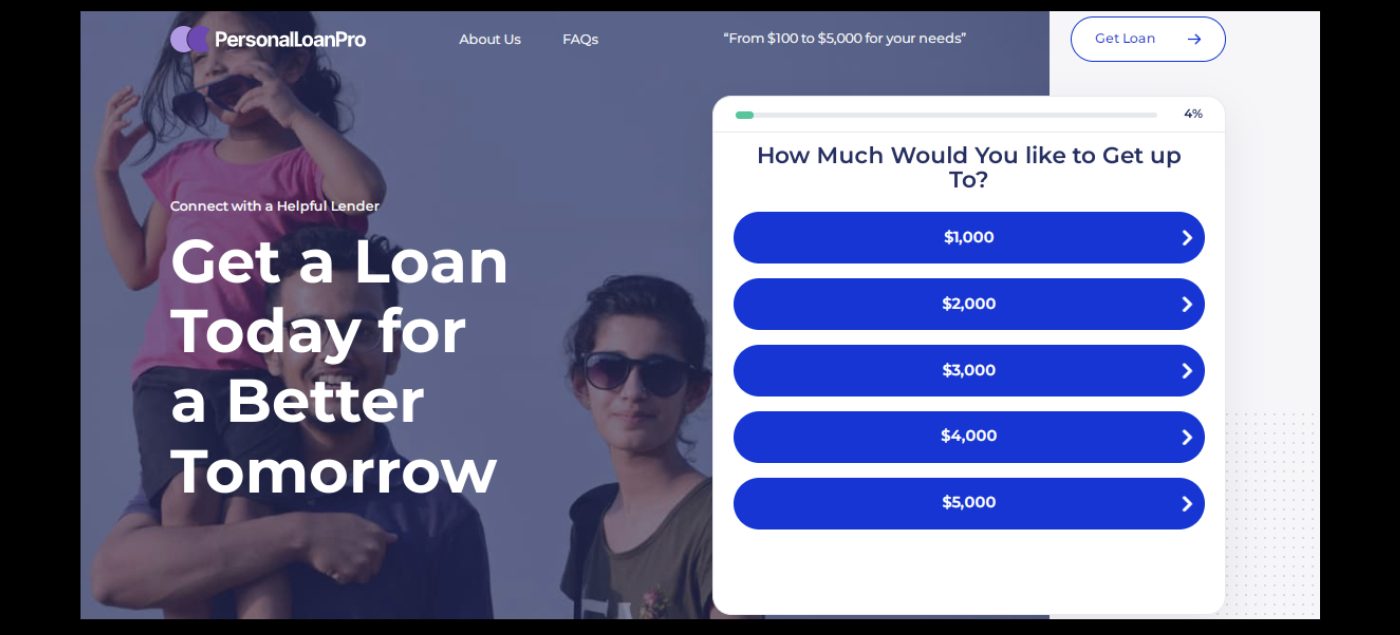

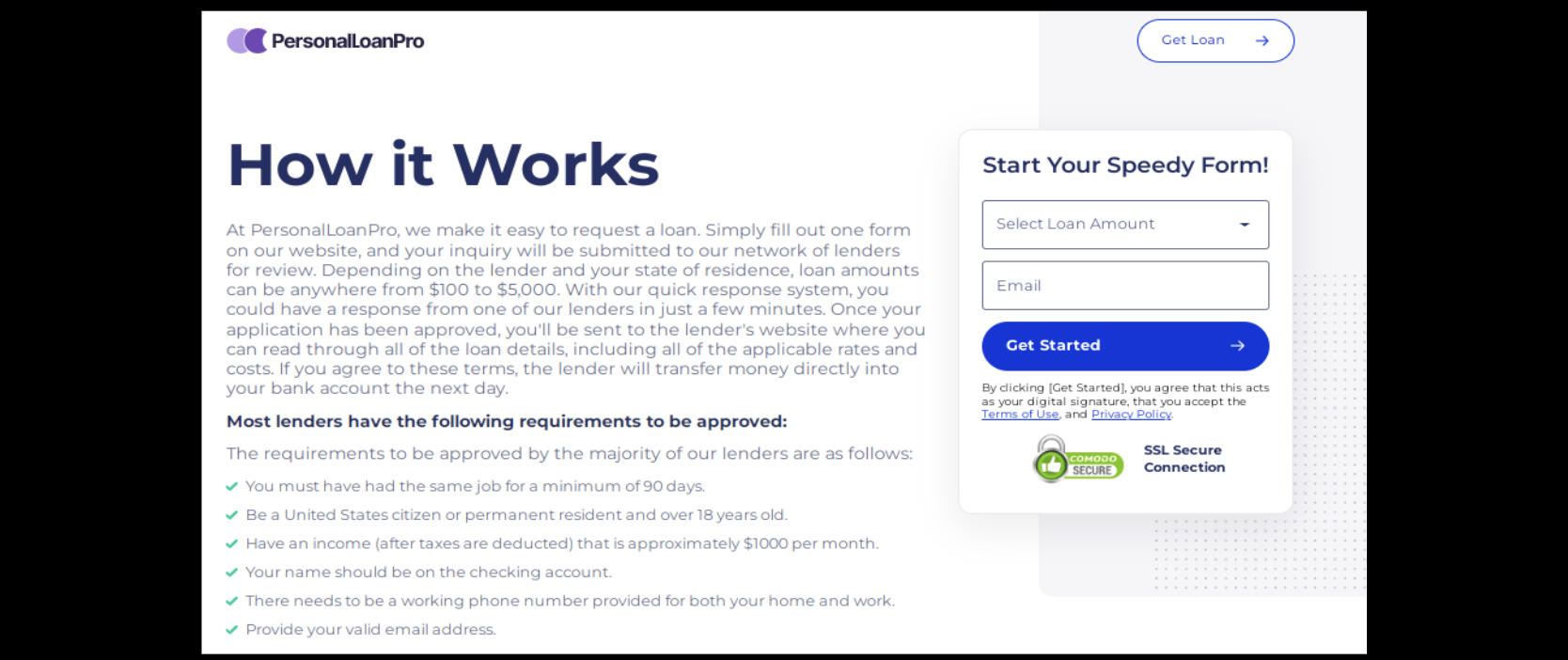

Online lenders often have lower interest rates, and many of them cater specifically to people with bad credit. You can go on this website of Personal Loan Pro to get different offers from different lenders who are able to provide bad credit personal loans.

You can also try a peer-to-peer lending site. These sites connect borrowers with individual investors, and many of them offer loans to people with bad credit. The interest rates may be a bit higher than those from online lenders, but they can still be a more affordable option than going to a traditional bank.

If you’re looking for a loan with very bad credit, you may want to try a payday lender. These lenders offer short-term loans, and the interest rates and fees can be quite high. However, they may be your only option if you need money quickly.

No matter where you decide to go for a bad credit personal loan, be sure to compare interest rates and fees as you can on the Personal Loan Pro website. Don’t just go with the first lender you find. By shopping around or using Personal Loan Pro you may be able to find a loan that’s more affordable and fits your needs.

What Is The Credit Score Needed To Get Personal Loans?

When it comes to getting personal loans, there are many things that lenders will take into consideration. Your credit score is one of the most important factors, as it can dictate the interest rate you’ll receive on your loan. So, what is the credit score needed to get personal loans?

Typically, you’ll need a credit score of at least 600 to qualify for a personal loan. However, this varies depending on the lender. Some may be willing to work with borrowers who have a score of 550 or even 500, while others may require a score of 650 or higher.

If you’re thinking about applying for a personal loan, it’s important to know your credit score and what it can qualify you for. If your credit score is on the lower end, don’t worry. There are ways to improve it. You can start by checking your credit report for errors and correcting them.

You can also pay off any outstanding debts and make on-time payments for your current debts. And, if you have a few months to improve your score, you can apply for a secured credit card or a credit builder loan.

Whatever your credit score may be, it’s important to be aware of the types of loans you’re eligible for. You can find and compare lenders who offer you bad credit personal loans on PersonalLoanPro official website easily. By knowing your credit score range, you can work on improving your score and start applying for the loans you need.

How To Apply For Personal Loans With Bad Credit?

If you are looking for a personal loan but have bad credit, you may be wondering if you will ever be able to get one. The good news is that there are lenders who will work with borrowers who have a less-than-stellar credit history. However, you will likely have to pay a higher interest rate and may need to provide more documentation.

Here is a guide on how to apply for personal loans with bad credit.

Step 1.

The first step is to find a lender that specializes in loans for borrowers with bad credit. There are a number of them online, and you can compare interest rates and terms on different websites like Personal Loan Pro. Be sure to read the fine print, as there may be restrictions on what you can use the loan for or how long you have to pay it back.

Step 2.

Once you have selected a lender, you will need to provide some personal information, including your name, address, Social Security number, and income. You will also need to provide information about your credit history, such as your credit score and the number of late payments you have made. You may be asked to provide documents such as pay stubs or bank statements to prove that you can afford the loan.

Step 3.

If you are approved for a loan, you will likely need to provide a down payment. The amount you need to pay will depend on the lender and your credit history. You may also need to agree to a higher interest rate.

It is important to remember that taking out a personal loan with bad credit can be risky. You may end up paying more interest than if you had a good credit score. It is important to weigh the pros and cons of taking out a loan before you apply.

Pros And Cons Of Bad Credit Personal Loans

When you’re dealing with bad credit, it can be tough to find a personal loan. Many lenders will shy away from approving a loan for someone with a low credit score, and those that are willing to work with you will often charge high-interest rates.

But there is some good news: there are lenders who specialize in bad credit personal loans. These loans can be a great option for people who need a little help getting back on their feet.

Before you apply for a bad credit personal loan, it’s important to understand the pros and cons. Here are the pros and cons of bad credit personal loans:

Pros:

- They can help you rebuild your credit score.

One of the biggest benefits of a bad credit personal loan is that it can help you rebuild your credit score. When you make regular payments on your loan, you’re demonstrating that you’re responsible with your money and can be trusted to pay back what you owe. This can help improve your credit score over time.

- They’re often more accessible than other types of loans.

Bad credit personal loans are often more accessible than other types of loans, such as mortgages or car loans. This is because lenders know that people with bad credit are more of a risk, and are therefore more likely to charge higher interest rates. But, because bad credit personal loans are designed specifically for people with bad credit, they often have lower interest rates than other types of loans.

- They can help you cover unexpected expenses.

If you suddenly need to cover an unexpected expense, such as a medical bill or home repair, a bad credit personal loan can be a great option. These loans can provide you with the money you need to cover unexpected costs without having to put your budget or credit score at risk.

Cons:

- They can be expensive.

Despite the fact that bad credit personal loans often have lower interest rates than other types of loans, they can still be expensive. So, before you apply for a loan, make sure you understand the interest rate and how it will affect the total cost of the loan.

- They can be difficult to qualify for.

Lenders that offer bad credit personal loans are typically more selective about who they approve for a loan. This means that you may have a harder time qualifying for a bad credit personal loan than you would for a loan from a traditional lender.